Options Premiums Explained

An option is the right but not the obligation to purchase or sell an asset at a specific price, on or before a certain data. Options trade at a price called a premium which is the amount a buyer pays a seller for the right to exercise an option. The premium of an option changes with market sentiment. The value of that premium is based on a number of factors which include the underlying price of the asset, the time to maturity, current interest rates and implied volatility.

A call option is the right to purchase a security at a specific price while a put option is the right to sell a security at a specific price.

Binary Options trade on regulated exchanges, and fluctuate with market sentiment. The price at which an option transacts is generally the premium of the option. There are some cases, such as in the currency markets, where options trade at an implied volatility value, which is then used to back into the premium of the option.

The option buyer pays the seller a premium when an binary option transaction is finalized, and has no other obligation to the seller regardless of the price of the underlying security. The most that an option buyer can lose by owning an option is the premium paid to the seller. The seller of a call option on the other hand has unlimited risk as the underlying price of a security can rise to infinity. The risk for a put option seller is similar although most securities are bounded by zero and therefore the risk is not theoretically unlimited.

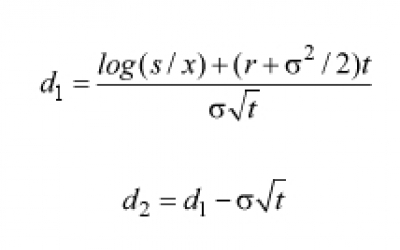

The premium of an option changes with market sentiment but is estimated using an option pricing model which determines the change that the option will be in the money based on a number of factors. The most important of these inputs is implied volatility which is an estimate of how much a security will move over a specific period on an annualized basis.

Implied volatility is quoted as a percentage, which reflects how much in percent terms a security will move from the current price over the next 12-month period.

The most active and well know value of implied volatility is the VIX volatility index. The index reflects the “at the money” volatility for the S&P 500 index. For example, the value of 16.86% means that investors believe that the S&P 500 could move nearly 17% from the current levels either higher or lower within the next year.

Time to maturity also plays a significant role in generating a value of a premium for an option. Longer times to maturities of options create higher premiums. For example, an option that expires in 30 days with X strike price and Y underlying stock price will have a lower premium than a similar option that has the same strike price and underlying price that expires in 60 days. The premium of an option erodes as the expiration date approaches, an eventually is worth nothing when the option expires.

Read our other article:

Comments

Post a Comment