The crucial role of delta in options trading

Without at least a basic understanding of options delta, nobody should venture into the world of options trading. Delta, one of the so-called Options Greeks, plays such a vital role both in options pricing that without understanding how it works, most traders are bound to make costly mistakes.

Definition

In laymen’s terms one can simply define delta as the amount an option would move in response to a $1 movement in the price of the underlying asset (stock, currency, commodity).

How delta works

An option with a delta approaching 1 (e.g. deep in the money options) would move $1 for every $1 movement in the price of the underlying asset. For call options delta is positive, i.e. the value of the option increases when the price of the underlying asset increases and decreases when this price drops.

Put options, on the other hand, have negative delta. This means the price of the option drops when the price of the underlying asset increases. When the price of the underlying asset drops, however, the value of a put option will increase.

Delta and option moneyness

When most people enter the world of options trading, they start off by buying options – very often ATM call options. The delta of an ATM option is very close to 0.5, which means that with every $1 the price goes up, the value of the ATM call option will go up by $0.50.

When the price of the underlying asset drops, the value of the ATM call will drop by $0.50 for every $1 drop in the price – but of course it’s value can’t drop to less than zero, which limits the maximum loss for a call options buyer.

The further one moves away from the current price, the lower the option’s delta will be.

Far out of the money options (far OTM options) have deltas as low as 10% or even lower. For every $1 movement in the price of the underlying asset, these options only move $0.10.

Time and delta

As an options trade moves closer to expiration, the delta of OTM options decreases and the delta of ITM options increases.

Implications for options traders

While it’s important to know whether the value of options will decrease or increase with a rise or fall in the price of the underlying asset, delta also has another useful purpose: it gives a very good indication of the probability that a particular option will expire ‘in the money.’

An option with a Delta of 0.5 therefore has roughly a 50% chance of ending in the money at expiration. A far OTM option with a Delta of 0.10 (10%) only has about a 10% probability of expiring in the money. Note: this is only a close approximation.

Delta and volatility

If the market suddenly turns more volatile after a trader bought an OTM option, the delta of that option will increase, i.e. the probability that it will end in the money will become higher.

Advanced delta

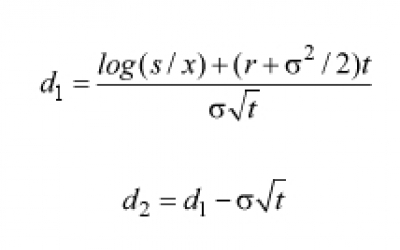

For advanced traders the Black-Scholes Model provides a way to calculate delta.

Where:

t = Option life as a percentage of year

s = Current value of underlying asset

r = Risk free rate of return

log = Natural log of

Read our other article:

Comments

Post a Comment